A group of United States senators and representatives are demanding answers after United States military servicemembers received anti-terrorism training that included instructions to consider pro-life Americans as potential terrorists.

It is unclear why the military would be training for combat against Americans on American soil.

Senators James Lankford (R-OK) and Ted Budd (R-NC), along with Representative Richard Hudson (R-NC) and their colleagues, “sent a letter to Secretary of the Army Christine Wormuth demanding answers after an anti-terrorism training conducted at Fort Liberty, North Carolina depicted Pro-Life Americans as terrorists,” Lankford’s office reports.

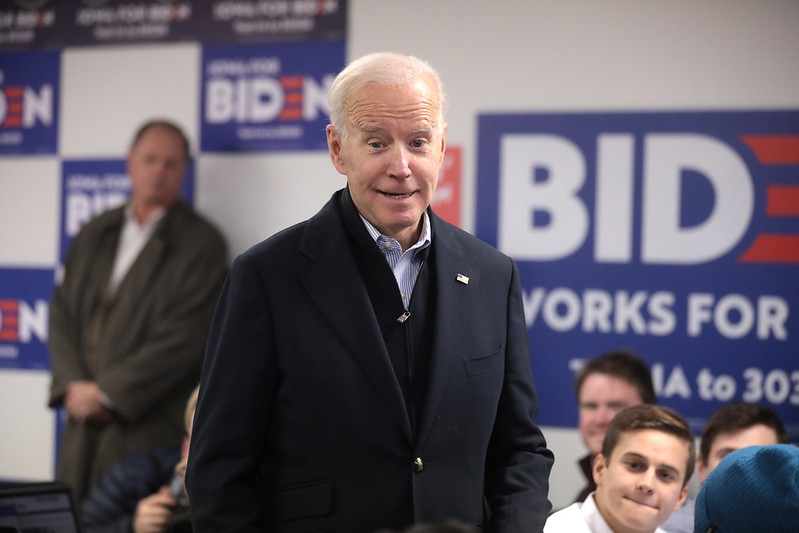

“We write regarding social media reports that anti-terrorism training conducted at Ft. Liberty, North Carolina depicts Pro-Life Americans as terrorists. Specifically, the slides identify National Right to Life, ‘Choose Life’ license plate holders, and anyone who opposes the Supreme Court’s rightfully overturned decision in Roe v. Wade, which was rightfully overturned by the Supreme Court, as members of terrorist groups. Smearing Pro-Life Americans is despicable and emblematic of the ongoing politicization of the military under the Biden-Harris Administration,” the Members wrote.

The National Right to Life Committee is a peaceful mainstream conservative organization. The training did not mention pro-abortion groups such as “Jane’s Revenge,” which have been engaged in a nationwide campaign of domestic terrorist attacks on pregnancy centers and Catholic churches.

“It is no wonder that the Army is struggling to recruit young men and women to join its ranks when it appears the service attacks their values and promotes a woke agenda rather than improving readiness and lethality…The American people deserve to be assured that these slides truly do not reflect the Army’s views, that a full investigation will be conducted, and that any offending employees will be properly held accountable. Finally, we must be assured that similar materials are not being utilized at other installations across the Army,” the Members continued.

Senators Thom Tillis (R-NC), John Barrasso (R-WY), Roger Wicker (R-MS), Marco Rubio (R-FL), Tom Cotton (R-AR), Ted Cruz (R-TX), Mike Lee (R-UT), Steve Daines (R-MT), Lindsey Graham (R-SC), Markwayne Mullin (R-OK), Tommy Tuberville (R-AL), Kevin Cramer (R-ND), Todd Young (R-IN), Deb Fischer (R-NE), Eric Schmitt (R-MO), Mike Braun (R-IN), Jim Risch (R-ID), Cindy Hyde-Smith (R-MS), Mike Crapo (R-ID), and Bill Hagerty (R-TN) also signed the letter.

The letter is supported by Catholic Vote, National Right to Life Committee, Family Research Council, Americans United for Life, Concerned Women for America, Students for Life Action, SBA Pro-Life America, Ethics & Religious Liberty Commission, and ACLJ Action.

The letter reads:

Dear Secretary Wormuth,

We write regarding social media reports that anti-terrorism training conducted at Ft. Liberty, North Carolina depicts Pro-Life Americans as terrorists. Specifically, the slides identify National Right to Life, “Choose Life” license plate holders, and anyone who opposes the Supreme Court’s rightfully overturned decision in Roe v. Wade,which was rightfully overturned by the Supreme Court, as members of terrorist groups. Smearing Pro-Life Americans is despicable and emblematic of the ongoing politicization of the military under the Biden-Harris Administration.

The American public expects the Department of Defense and its personnel to defend the homeland from actual terrorists, not Americans who seek protections for children in the womb. Labeling Pro-Life organizations as threats challenges servicemembers’ moral obligation to defend and protect even the smallest among us. In fact, around half of all Americans identify as Pro-Life. It is no wonder that the Army is struggling to recruit young men and women to join its ranks when it appears the service attacks their values and promotes a woke agenda rather than improving readiness and lethality.

We understand that the anti-terrorism slide was in fact briefed to a group of soldiers as recently as July 10th. What is unclear is how long these slides have been utilized at Ft. Liberty and whether similar briefings have been used at other installations. We also understand from a statement released by Ft. Liberty that these slides were not vetted by appropriate approval authorities.

While Ft. Liberty’s statement asserts that the slides “do not reflect the views of the … US Army or the Department of Defense”, the American people are rightfully concerned that training of this kind is being disseminated in the first place and possibly at other military installations. The American people deserve to be assured that these slides truly do not reflect the Army’s views, that a full investigation will be conducted, and that any offending employees will be properly held accountable. Finally, we must be assured that similar materials are not being utilized at other installations across the Army.

Therefore, we request responses to the following questions no later than July 29, 2024:

Is it official Army policy to identify Pro-Life Americans and Pro-Life Organizations as “terrorist groups”?

How long have these slides been briefed to soldiers and how many soldiers have been briefed with these slides?

What is the current process by which the Army reviews anti-terrorism training materials disseminated on Army bases?

Who are the appropriate approval authorities charged with vetting training materials disseminated to soldiers across the Army?

What action is the Army taking to investigate the distribution of training materials depicting Pro-Life Americans as terrorists?

What statutes or Army regulations were potentially violated and what action is the Army taking with regard to any offending employee?

Will you commit to an installation-by-installation review to ensure that these or similar materials are not being disseminated elsewhere and that Army anti-terrorism training aligns with DoD anti-terrorism standard guidance and training?

Will you commit, in writing, that these slides will no longer be used and all future training materials reviewed will align with current DoD anti-terrorism guidance?

We look forward to your prompt attention and response.

Opinions expressed by contributors do not necessarily reflect the views of Great America News Desk.